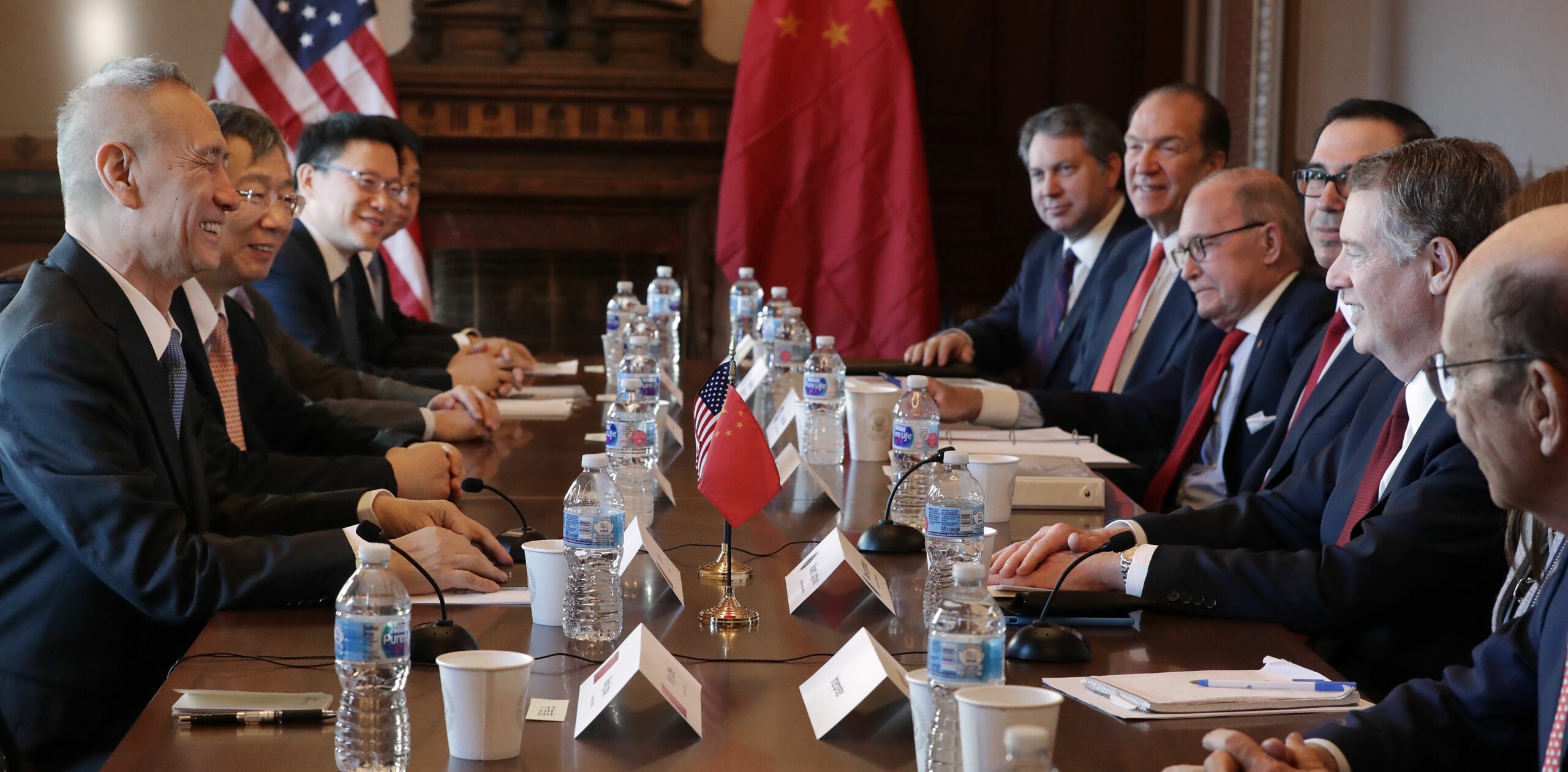

Investors should remain optimistic about the ongoing negotiations between the U.S. and China, according to an expert.

Speaking to CNBC’s “Street Signs” two weeks ago, Peter Andersen, chief investment officer at Massachusetts-based Andersen Capital, said that “everyone wants to negotiate for their own good,” so that suggests there will be a positive outcome from the U.S.-China talks.

According to Andersen, the involved parties are “intelligent enough to realize that a mutually beneficial solution is the best way to go.” In other words, current negotiations are not likely to result in damages to either side.

“As long as there is engagement, and as long as there is pen put to paper and … a memorandum of understanding is being drafted, et cetera, I think that’s all very positive,” Andersen said.

Despite a cloud of uncertainty hanging heavily over current trade negotiations, the fact that the world’s two largest economies have taken the step of engaging diplomatically shows that an ideal outcome is a possibility.

“What we have to worry about is: What are the details of the agreement? Is it something really substantial, which would be fantastic; or is it something more symbolic, and indicative of further discussions and negotiations down the road?” Andersen said. “But even if that happens, that is a tremendously positive sign because look how far we’ve come compared to where we were, say, a year ago — just dreaming about negotiations.”

However, while it might be tempting to speculate about the final result, Andersen emphasized that investors should decouple political events and trade because the situation is currently still “highly uncertain,” with insufficient data available for analysis.

“We can watch very closely as to what’s going on with President (Donald) Trump, but in terms of actually having solid data on which to do analysis on as compared to stock analysis, it is really really thin, ” said Andersen.

He suggested watching consumer sentiment closely to gauge market sentiment.